I wrote this article with the aim of providing useful advice to all new graduates starting their first job. I know how confusing it can be to navigate the various savings and investment options available in Canada. Indeed, any new graduate can find themselves baffled by these financial products. My goal is to simplify and clarify these options, particularly by closely examining popular savings plans such as the TFSA, RRSP, RESP, and FHSA. By better understanding these plans, we can all make more informed financial decisions and thus ensure our future financial security.

Tax-Free Savings Account (TFSA)

Earnings within the account are entirely tax-free, which includes returns such as interest, dividends, and capital gains, even at the time of withdrawal.

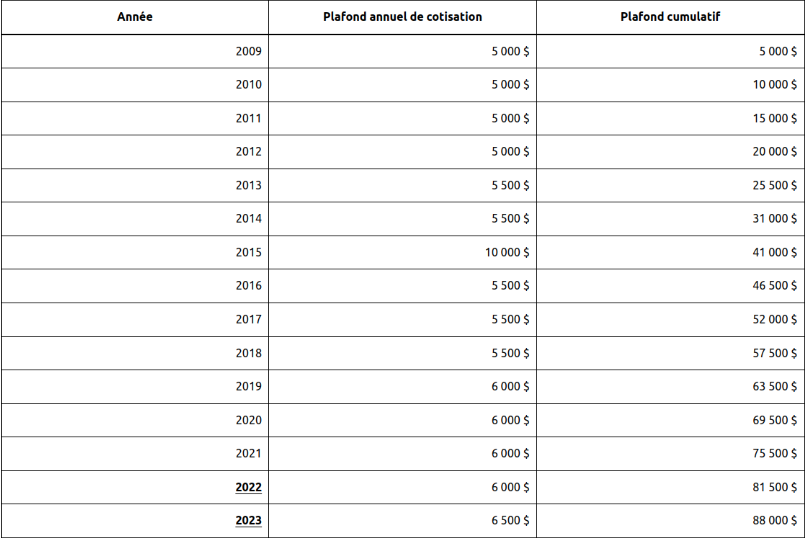

Regarding annual contribution limits:

- They are capped by your annual contribution room. If you exceed this limit, the excess amount will be subject to tax, with a penalty of 1% per month.

- Your contribution room accumulates each year, even if you haven’t opened a TFSA. This means it’s never too late to start saving.

- The annual contribution limit for a TFSA in 2023 is $6,500.

- Contributions to a TFSA are not tax-deductible, but withdrawals are tax-free.

- Additionally, dividends and interest earned within a TFSA do not count towards the annual contribution limit.

As for TFSA withdrawals:

- They are entirely tax-free at any time.

- Withdrawn amounts can be re-contributed to the TFSA only at the beginning of the following year. This allows you to fully benefit from the account’s tax advantages.

TFSA Advantages

The Tax-Free Savings Account (TFSA) offers numerous advantages, as illustrated by the example of Mr. X:

- Mr. X invests $5,000 in a Guaranteed Investment Certificate (GIC) at 2% in his TFSA. After 5 years, the total reaches $5,520, including $520 in investment income.

- The benefits of the TFSA are numerous:

- No Tax on Investment Income: The $520 of income is not taxable as it is housed within the TFSA.

- Comparison with a Non-TFSA Investment: Without the TFSA, a tax rate of 37.1% would have reduced the accumulation to $5,323, $197 less.

- Tax Advantage upon Withdrawal: Whether it’s the initial capital or the income, no tax is applicable upon withdrawal.

- In conclusion, the TFSA offers a tax-advantaged investment strategy for Mr. X, allowing him to maximize returns and minimize taxes.

Understanding TFSA Contribution Room

TFSA contribution room is determined by several important rules:

- Your annual contribution room is limited by tax legislation. Exceeding this limit results in tax consequences, with the excess amount subject to tax and a penalty of 1% per month.

- It is essential to know that your contribution room accumulates each year, even if you haven’t yet opened a TFSA. Thus, it’s never too late to start saving in a TFSA.

- In 2024, the annual contribution limit for a TFSA was $7,000. (source)

- Contributions to a TFSA are not tax-deductible, but withdrawals are tax-free.

- Additionally, dividends and interest earned within a TFSA are not included in the annual contribution limit.

Managing TFSA Withdrawals

Regarding TFSA withdrawals:

- TFSA withdrawals are tax-free at any time.

- Any amount withdrawn can be re-contributed to the TFSA only at the beginning of the following year, which requires careful planning to maximize the tax advantages of this savings plan.

Where to Invest with a TFSA?

- Stocks

- Government or corporate bonds

- Exchange-Traded Funds (ETFs)

- Real Estate Investment Trusts (REITs)

- Guaranteed Investment Certificates (GICs)

- Mutual Funds

Registered Retirement Savings Plan (RRSP)

Objective

The Registered Retirement Savings Plan (RRSP) aims to save throughout one’s working life to complement retirement income received from the state, such as the QPP/CPP.

Advantages

The RRSP offers several interesting advantages:

- Tax Reduction:

- RRSP contributions reduce taxable income, thanks to a descending tax bracket.

- Tax Deferral on Accumulated Income:

- Income accumulated within the RRSP is tax-deferred as long as it remains in the account.

- Tax Paid at Retirement:

- Tax is paid when funds are withdrawn at retirement, potentially at a lower tax rate than during working life.

- Tax-Deferred Account:

- The RRSP functions as a “tax-deferred” account, where tax is deferred until withdrawal, unlike a “tax-free” account.

Contribution Limit

In 2023, the contribution limit for your RRSP is $31,560. (source) If you do not use all your contribution room,

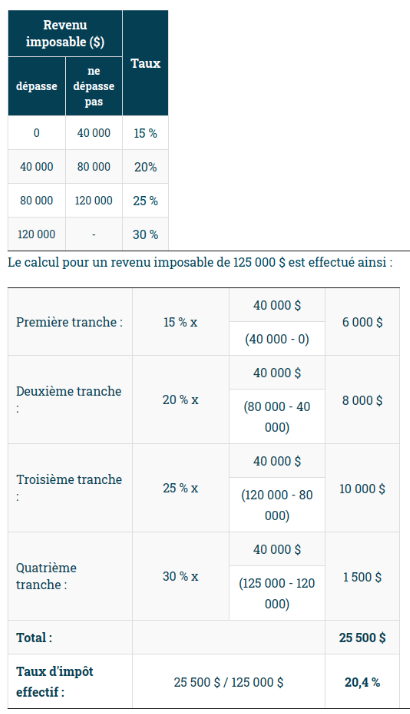

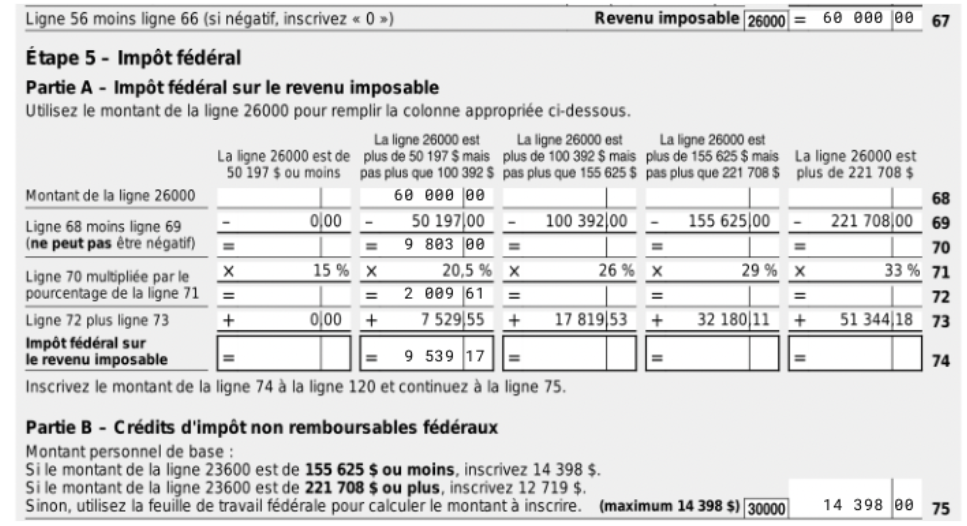

Marginal vs Effective Tax Rate

Myth or Reality?

If a taxpayer earns $90,000 per year and is offered a $10,000 annual raise by their employer, will the taxpayer “lose out” because they will move to a higher tax bracket?

Reality

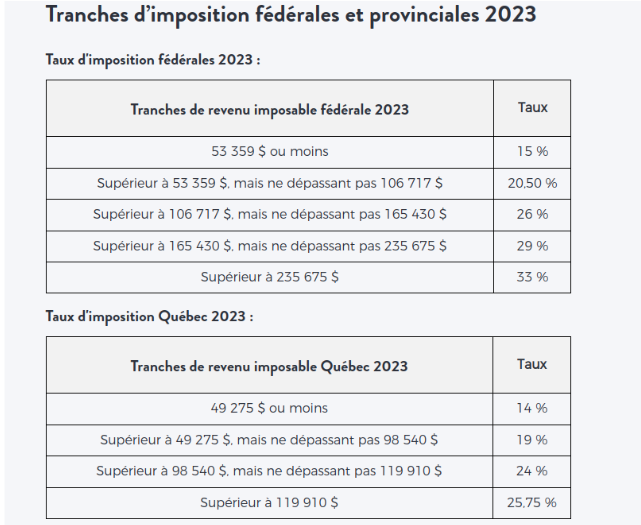

False! The reality is that the taxpayer will pay 37.118% tax (combined federal and provincial) on the first $2,580 and a rate of 41.118% on the remaining $7,420. It is false to claim that the new annual income of $100,000 will be fully taxable at 41.118%.

Definitions

The marginal tax rate represents the tax rate applied to the highest portion of a taxpayer’s additional income. It is the tax rate you pay on each additional dollar earned beyond your current income.

In contrast, the effective tax rate is the average percentage of tax you pay on your total income.

In addition to contributing to federal tax, Quebecers must also file a provincial tax return.

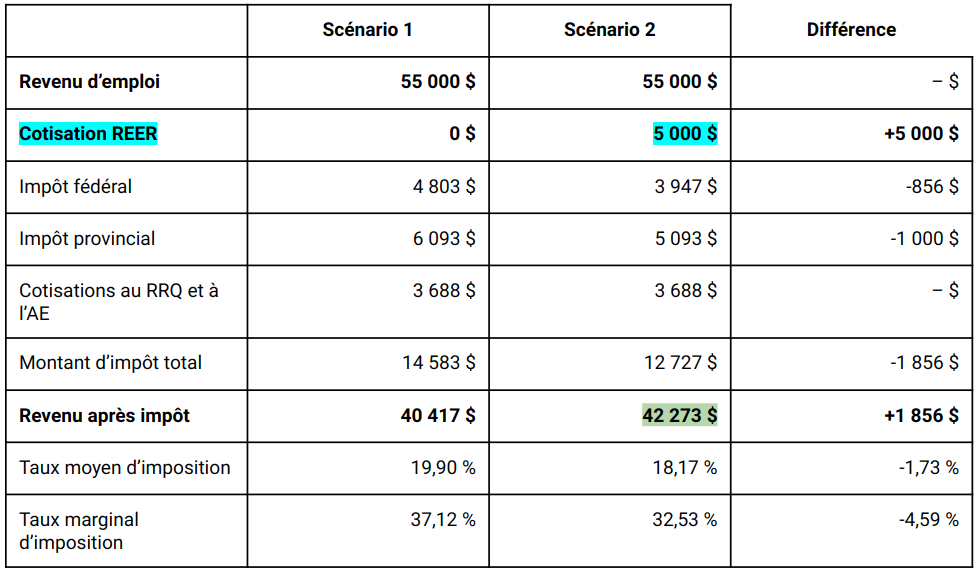

Registered Retirement Savings Plan (RRSP)

Why and How Does the RRSP Reduce Taxes Payable?

- The RRSP reduces taxes by decreasing taxable income.

- The tax refund is calculated based on the marginal tax rate, the highest rate.

- Example: John has an annual income of $55,000, a $5,000 contribution to the RRSP.

- Taxable income: $50,000 ($55,000 - $5,000).

- The tax refund concerns the tax paid on the last $5,000 earned.

Additional Tax Benefits

As previously demonstrated, contributions made to the RRSP reduce taxable income. By decreasing your taxable income, you benefit from several additional tax advantages:

- Solidarity credit (Quebec)

- GST credit (Canada)

- Canada Child Benefit (CCB)

- Quebec Family Allowance.

Questions

Are there ways to enter a lower tax bracket?

- Tax credits reduce the anticipated taxes on an individual’s taxable income once the marginal tax rate has been applied to your taxable income.

Examples of tax credits:

- First-time home buyer’s tax credit

- Charitable donations

- Child activity tax credit

- Tax credit offered to investors receiving dividends from Canadian corporations to account for the fact that these corporations have already paid tax on their income.

Registered Education Savings Plan (RESP)

Objective

Save to fund a child’s post-secondary education.

Advantages

- The RESP is an account used to save up to $50,000 for a child’s post-secondary education.

- Income accumulated within the RESP is tax-deferred as long as it remains in the RESP.

- If the beneficiary (the child) does not pursue post-secondary education, it is possible to recover the contributions tax-free.

Notes

- Contributions to the RESP cannot be deducted on your tax return, unlike the RRSP.

- Government grants are paid into the RESP. These grants include the Canada Education Savings Grant (CESG), the Quebec Education Savings Incentive (QESI), and the Canada Learning Bond (CLB).

- The lifetime contribution limit for an RESP is $50,000 per beneficiary.

First Home Savings Account (FHSA)

Objective

Save tax-free for the purchase of a first home.

Advantages

- Annual contribution limit of $8,000, a lifetime contribution limit of $40,000, and the ability to carry forward unused contribution room.

- Contributions to the FHSA are tax-deductible, like the RRSP, and can be carried forward to future years.

- Investment returns within this type of account are tax-free and will not be included in your income.

Notes

- Investments in the FHSA can include stocks, bonds, ETFs…

FHSA or “Borrow” from an RRSP: What’s the Difference?

- Repayment of Withdrawn Money: Money withdrawn from an FHSA never needs to be repaid. An RRSP withdrawal under the HBP must be repaid over 15 years starting the second year after the withdrawal.

- Maximum Annual Contribution: The maximum annual contribution for an FHSA is $8,000, and the lifetime limit is $40,000. For an RRSP, it is the smaller of 18% of your salary or the annual limit set by the government ($30,780 in 2023).

- Maximum Withdrawal Amount: There is no maximum withdrawal amount for the FHSA, unlike the HBP where an RRSP withdrawal cannot exceed $35,000.

Ready for part 2? Now that we’ve reviewed the various investment vehicles, it’s time to dive into the fascinating world of stock analysis. Buckle up, because we’re about to discover how to invest smartly in stocks to grow your wealth.

Stock Analysis

Fundamental Analysis

Fundamental analysis is one of the two main types of analysis used by investors to evaluate a stock or a company.

Types of Investment:

- Intraday (1 day)

- Short term (2 days to 3 months)

- Medium term (3 months to 1 year)

- Long term (1 year and more)

Objective: The goal of fundamental analysis is to determine a company’s intrinsic value by evaluating its financial fundamentals. Here are some of the key metrics used in this analysis:

-

Revenue and Sales: Total sales of its products or services over a given period.

-

Earnings and Profits: Net earnings and profit; income remaining after subtracting all expenses, including taxes.

-

Profitability Ratios:

- Profit Margin: The profit margin ratio shows what proportion of sales turns into net income.

- ROA (Return on Assets): This ratio measures the profitability of the company’s assets.

- ROE (Return on Equity): Profitability relative to the company’s equity.

-

Debt Management Ratios:

- Debt-to-Equity Ratio: Proportion of debt relative to the company’s equity.

- Interest Coverage Ratio: Demonstrates whether the company can cover its interest expenses with its earnings.

-

Valuation Ratios:

- Price/Earnings (P/E) Ratio: It compares the current stock price to earnings per share and indicates whether a stock is overvalued or undervalued.

- Price/Book (P/B) Ratio: It compares the stock price to its net book value per share.

-

Growth Prospects: Expansion plans, innovations, and industry trends.

Technical Analysis

Technical analysis relies on examining historical price and trading volume data to identify trends and recurring patterns. Here are some key elements of technical analysis:

Chart Patterns:

Recurring patterns, such as triangles, head and shoulders, provide indications of future price movements.

Technical Indicators:

Mathematical indicators, such as moving averages and the Relative Strength Index (RSI), help confirm trends and identify entry and exit points.

Volumes:

Trading volumes are used to confirm price movements. An increase in volumes can indicate a trend reversal.

Self-fulfilling Prophecy

Have you ever wondered how some market predictions seem to come true almost like magic? This is where the theory of the self-fulfilling prophecy comes into play. Imagine this: if even a small fraction of traders believe in a certain trend, it can be enough to influence the market in that direction.

It’s a bit like the confidence of investors in a prediction contributing to its realization. Think about it: if 10% of traders firmly believe in a price rise, it can encourage others to follow suit, creating a self-fulfilling prophecy.

How does this apply to trading and technical analysis (TA)? Well, technical analysis often relies on these thought patterns. Traders use recurring patterns and mathematical indicators to anticipate future price movements. And guess what? The mere belief in these patterns can often make them effective.

It’s a fascinating subject, isn’t it? To dive deeper into this idea, you should check out Quant’s article on the justification of technical analysis. Trust me, it’s worth exploring!

Note that in the case of cryptocurrencies, where fundamental data can be limited or difficult to assess, technical analysis often takes a predominant role.

Where to Place Your Money:

Investing your money can seem like a real challenge, especially when looking for reliable and stable returns. Fortunately, there are several options in the financial market that can meet your needs. Here is an overview of the main investment options:

Guaranteed Investment Certificates (GICs): The Guarantee of a Stable Return

Main Characteristics:

- Guaranteed Return Rate: GICs offer a fixed or variable return rate, ensuring a certain predictability.

- Fixed Duration: You can choose the investment period, ranging from a few months to several years.

- Capital Security: Generally, the invested capital is guaranteed, offering protection against losses.

- Variety of Types: You can opt for non-registered GICs, subject to annual interest taxation, or registered GICs in tax-advantaged accounts like the RRSP or TFSA.

Investment Flexibility:

- Open GICs: You have the option to withdraw your money at any time.

- Closed GICs: These GICs must be held until maturity, often offering higher interest rates.

Advantages of GICs:

- Security: Capital protection makes it an ideal choice for those seeking financial stability.

- Predictability: With a guaranteed return, you know exactly what to expect, which can be reassuring in a volatile market.

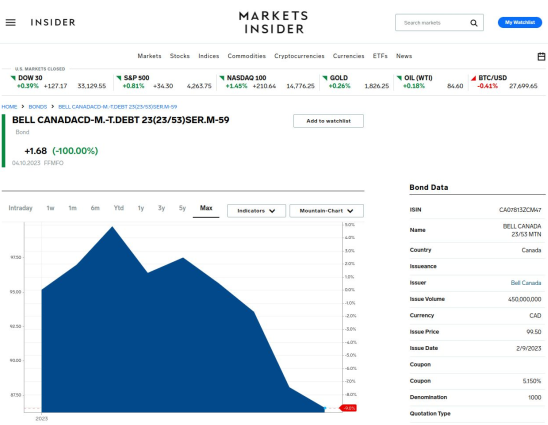

Bonds: A Stable Source of Income

Bonds are financial instruments that offer an attractive alternative for investors concerned with preserving their capital while generating regular income. Here is a comprehensive overview of the characteristics and advantages of bonds:

1. Issuers:

- Bonds can be issued by different types of entities, including national and regional governments, as well as private companies.

2. Characteristics:

- Interest rate (or coupon): Bonds offer a periodic fixed or variable interest paid to the investor based on the invested amount.

- Maturity: This is the lifespan of the bond, at the end of which the principal is repaid to the investor.

- Nominal value: This is the initial amount invested in the bond, which is repaid at maturity.

3. Rating:

- Bonds are evaluated based on their credit risk by rating agencies such as AAA, BB, etc., allowing investors to assess the level of risk associated with each bond.

4. Advantages:

- Stable source of income: Bonds offer regular income in the form of periodic interest payments.

- Less volatile than stocks: Bonds are generally less subject to stock market fluctuations, making them a more stable investment.

- Portfolio diversification: Bonds can be used to diversify an investment portfolio and reduce overall risk.

Although bonds are considered less risky investments than stocks, it is important to note that they can be sensitive to interest rate fluctuations.

A 5% coupon on a Bell Canada bond means that bondholders will receive a payment equivalent to 5% of the bond’s nominal value each year, in the form of interest. This type of bond can be attractive to investors looking for regular and stable income, given that the rate of return is fixed in advance and the payments are generally reliable.

Exchange-Traded Funds (ETFs)

Exchange-traded funds (ETFs) represent an increasingly popular investment option for many investors. These funds operate similarly to individual stocks but typically track a specific index, such as the S&P 500, or a particular asset category.

Key Characteristics:

-

Diversification: ETFs offer investors instant diversification as they hold a basket of underlying stocks or assets, reducing the overall investment risk.

-

Low Management Fees: ETFs generally have lower management fees than traditional mutual funds, making them an attractive option for cost-conscious investors.

ETFs offer a unique combination of diversification and liquidity, making them a versatile investment tool for those looking to build a balanced portfolio while minimizing associated fees.

Investing in ETFs allows you not to put all your eggs in one basket, as these funds provide instant diversification by grouping several assets within a single investment. This approach reduces overall risk by spreading investments across different sectors, geographic regions, or asset classes.

Here are the ETFs I recommend:

| Symbol | Description | Management Fees | Sector |

|---|---|---|---|

| VOO | Vanguard S&P 500 ETF | 0.03% | Large-cap US stocks |

| VTI | Vanguard Total Stock Market ETF | 0.03% | US stock market |

| QQQ | Invesco QQQ Trust | 0.2% | Technology |

| VFV | Vanguard S&P 500 Index ETF | 0.08% | Large-cap US stocks |

| VT | Vanguard Total World Stock ETF | 0.08% | Global stock market |

| GRO | iShares Growth Fund | 0.25% | Diversified |

| EQT | BMO Portfolio Balancing ETF | 0.2% | Diversified |

| VGRO | Vanguard Growth ETF Portfolio | 0.25% | Diversified |

These ETFs offer a variety of management fees and focus on different sectors and investment styles, ranging from large-cap US stocks to global diversification.

Mutual Funds

Mutual funds are investment instruments that pool funds from multiple investors to buy a diversified portfolio of stocks, bonds, or other securities. Here’s what you need to know:

- Professional Management: Funds are managed by finance professionals.

- Diversification: Allows investors to access a wide range of securities with minimal investment.

- Liquidity: Fund shares can generally be bought or sold on any trading day.

- Common Types: Equity funds, bond funds, money market funds, etc.

- Fees: Funds may have management fees and other associated costs. Mutual funds offer an easy way for investors to access the market while benefiting from diversification and professional management.

Many investors turn to mutual funds for professional management and diversification. However, it is crucial to recognize the significant impact of associated fees on long-term returns. Personally, I consider the issue of fees often overlooked and can represent a real scam for long-term investors. In my next article, we will delve deeper into the importance of minimizing fees to maximize long-term returns. Stay tuned!

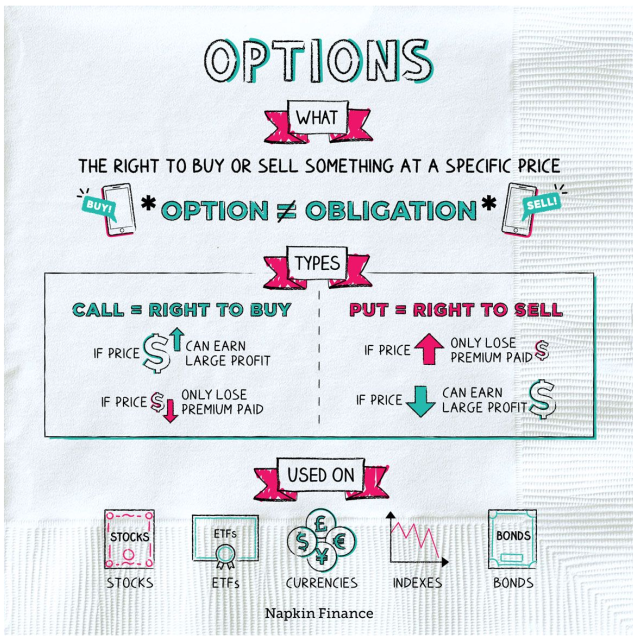

Options (Advanced)

Options are financial contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price before or on a specified date. Here’s what you need to know:

- Types:

- Call: Right to buy the asset.

- Put: Right to sell the asset.

- Elements:

- Strike Price: The price set in the contract for purchase/sale.

- Expiration Date: The date on which the option becomes void.

- Uses:

- Speculation: Betting on the direction of the price.

- Hedging: Protection against price fluctuations.

- Risk:

- For Buyers: The loss is limited to the premium paid.

- For Sellers: The risk can be much higher. Options offer increased flexibility and leverage, but they can be complex and carry high risk.

In conclusion, I want to share with you a proverb that particularly resonates with me and that I recommend you adopt in your financial approach:

“Buy assets as if your life depended on it, your future self will thank you.”

Buy me a coffee

Buy me a coffee